There are a few times and reasons when you should update your classic car appraisal.

Phillip Metcalf at Hyman LTD in St Louis, Missouri had some very valuable points for me when we talked about the market and appraisals for collector cars. He said, “In an ever changing market it’s a great idea to regularly revisit the value of your vehicle. Doing so can help you protect the full value of your vehicle as markets go up. The converse is also true to help save on insurance premiums as markets stabilize.”

While the market goes up and down one might think the best time to update your classic car appraisal is when the market is up. While this may help with the overall value of the car, there are other times in which you should update your classic car appraisal to protect your investment.

Be sure to get a Replacement Value Appraisal or Stated Value Appraisal when you purchase your vehicle and insure it with your insurance agency.

Some insurance companies may not “require” an appraisal for the stated value you are asking for. This does not mean that you should not have a Stated Value Appraisal or a Replacement Value Appraisal on file with your insurance company. While your insurance company may agree to the coverage value of the vehicle, this does not mean they will actually honor the full number at the time of a loss. The Stated Value Appraisal provides the actual value of the vehicle at a given point in time. Sadly I have been party of too many claims that occur in a low market and cars are totaled for low value versus that of having a replacement value already stated in their policy. Getting a classic car appraised for replacement value at the time of purchase at least sets the bottom line from day one.

Make sure you update your Collector Car Replacement Value Appraisal or Stated Value Appraisal when any major upgrades or repairs are done.

Sadly, too many of times clients call me after a loss and their insurance company is not honoring the recent $20,000 paint job done or the $10,000 interior that was just replaced on their collector car. While it may have been just done, the insurance company looks at that fresh paint job or interior as a melted mess after a fire or a crushed car after a garage collapse. They are usually stuck between a rock and a hard place. They can’t confirm the quality of the work after the fact and have to look at it as any other car. This is where that Replacement Value Appraisal comes into play. The collector car appraisal documents the who, what, when and how much it was and the quality of that work. This is your best chance at getting that value placed into the loss claim. Sometimes insurance companies will allow receipts to prove the work being done, but they will sometimes also dispute the quality of the work. A good appraisal report will include photos and document as much as possible just in case the unfortunate does happen.

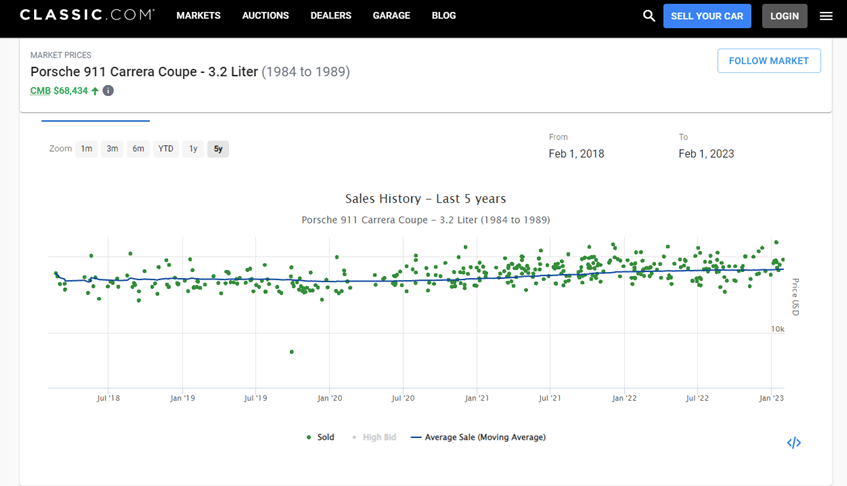

When you see the market increase on your specific vehicle is also a good time to update your Classic Car Replacement Value Appraisal.

While I know I stated earlier that just because the market is up across the board on classic cars is not necessary a time to update your replacement value appraisal, if you see that the select market on your is up and stays up it is a good time to update your appraisal. The difference of the overall classic car market and the specific market on your vehicle is usually due to specific factors such as death of the designer or even an actor that owned that vehicle model. Another factor that usually increases specific model markets is a passing of the restorer of that vehicle. For instances the overall classic car market usually goes up when the stock market is down, this is because investors sell off their shares before the market drops. Those same investors have funds available and invest in real property such as real estate, collectibles and classic cars. All three of these have proven to continue to hold their values in a recession and downturn in the stock market.